The Costa del Sol remains one of Spain’s most dynamic and coveted real estate markets in 2025. What started as a region largely driven by tourism is increasingly shaped by long-term residential demand, international investment, and a strong luxury segment. Key drivers include limited supply, rising construction costs, lifestyle preferences (wellness, sustainability, views), and strong foreign demand.

Key Trends

-

Record‐High Prices & Strong Growth Rates

-

As of August 2025, the average price of second-hand housing in Málaga province rose to about €3,842/m², marking a year-on-year increase of roughly 13.8%.

-

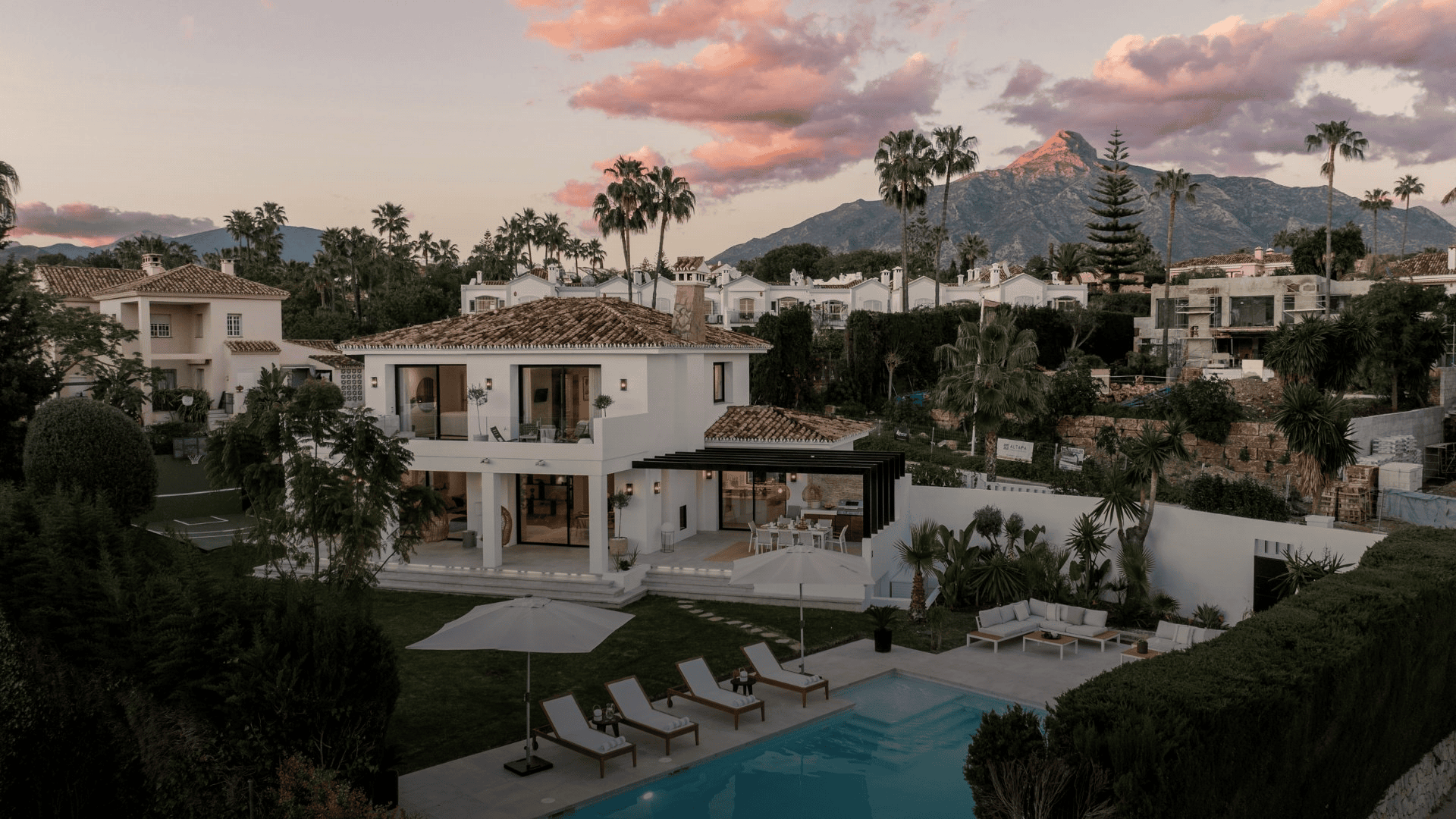

Premium areas such as Marbella and Benahavís lead the way, with prices above €5,200/m² in many cases.

-

Smaller towns are catching up in terms of growth rate. Towns like Algarrobo-Costa, Ojén, Caleta de Vélez, etc., have seen price increases of 20-30%+ in the last year.

-

-

Luxury Market Gains

-

The premium or luxury segment (homes priced above ~€3 million) continues to appreciate, though more modestly in percentage terms compared to less expensive areas.

-

Some very high price tags: in Marbella, ~18% of luxury homes sold in 2024 were priced over €10 million.

-

-

Strong International & Second-Home Demand

-

Foreign buyers remain central to the market. ~33-35% of property transactions in Málaga province in Q2 2025 involved foreign buyers. Top nationalities: UK, Germany, the Netherlands, Scandinavia.

-

Many buyers are looking for second homes, or combining holiday use with rentals. Some are relocating more permanently, especially retirees or location‐independent professionals.

-

-

New Build & Supply Constraints

-

There has been a notable increase in new build sales. In early 2025, in Andalucía, new build homes sales rose ~30.9% compared to the previous year. Málaga province is among the leaders.

-

However, supply is still tight, particularly of high-quality properties in prime locations. Infrastructure, zoning, land availability, and rising costs (materials, labour) are bottlenecks.

-

-

Increasing Importance of Sustainability, Technology, and Lifestyle Amenities

-

Buyers are more demanding: energy efficiency, green building features, sustainability certifications, and eco-friendly design are premium features that are increasingly expected.

-

Wellness, views, outdoor space, quality amenities (spa / fitness / nature / privacy) are high on the wish list.

-

-

Geographic Diffusion of Demand

-

While Marbella, Benahavís, Puerto Banús etc. continue to dominate in terms of absolute price, more buyers are looking at “fringe” or previously overlooked areas — hillside towns, smaller coastal towns, towns with character and good connectivity but lower price base. For example, Ojén, Algarrobo-Costa, Caleta de Vélez are rising fast in %-increase terms.

-

Emerging hotspots also include Estepona, Casares, parts of Mijas.

-

Risks & Challenges

-

Affordability: With rapid price rises, many local buyers are being priced out. Two-bed flats, even in non-prime zones, are reaching sums that are hard to finance for middle-income households.

-

Regulation & Planning Bottlenecks: Obtaining approvals, land use, urban planning, and infrastructure may lag behind demand. Also, environmental regulation (water scarcity, land use).

-

Interest Rates / Financing: Mortgage terms, interest rates, and borrowing cost remain relevant — any hikes or tighter regulations could dampen demand.

-

Overdependence on Foreign Demand: Currency risks, travel regulations, visa policies, economic conditions in buyer-source countries can affect this demand.

Forecast / What to Expect

-

Moderate to strong price growth will likely continue in many parts of the Costa del Sol through late 2025 and into 2026 — estimates are in the ballpark of 5-10%+ annual growth in many areas, with higher growth in hotspot locations or fringe towns.

-

The luxury segment will continue to perform well, though its percentage growth may be less dramatic than for more affordable coastal towns gaining popularity.

-

New builds will continue to gain market share, but only gradually — constrained by land, cost, regulations.

-

Properties offering strong lifestyle value (views, wellness, sustainability, connectedness) will outperform more basic units.

-

More buyers will be drawn by hybrid living models (e.g. part-year residents, combining enjoyment with rental revenue) and remote work will support demand in less urbanized or less densely built areas.

Implications for Buyers & Investors

-

If you’re buying now, prime locations are expensive, so look for emerging areas that offer good infrastructure and potential for capital appreciation.

-

Factor in not just purchase price, but ongoing costs (taxes, maintenance, community fees), especially for luxury homes.

-

For investment / rental income: holiday rentals remain profitable, but regulation is something to watch. Also, the “rent vs live in” trade-off matters.

-

For resale, high quality in materials, design, legality (documentation, licences) and amenities increasingly matter more than just location.